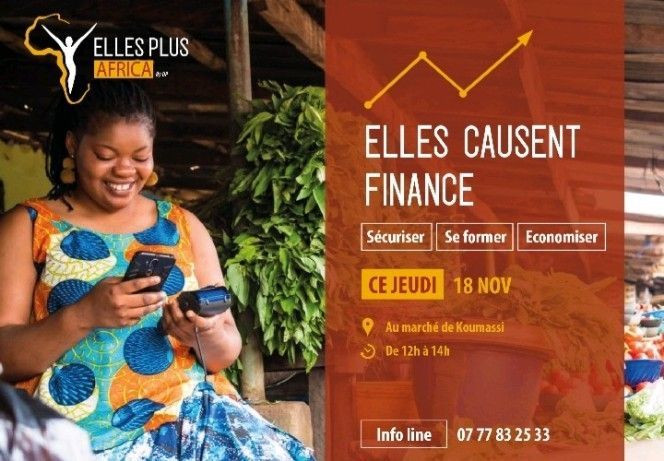

UNDERSTANDING THE POPULAR MASS MARKET:

Significant investment efforts have been made by all the actors involved in the development of financial inclusion in Sub-Saharan Africa.

Although this has led to a take-off in the banking rate of the urban masses in the main African cities, it is clear that on average over the last few years this rate has never reached 10% of the working poor population.

This urban mass, although impoverished for the most part, is a consumer of goods and is in need of banking and insurance financial services in the same way as the other goods that it already consumes massively.

The mastery of consumption habits and distribution circuits are essential in the strategic deployments of Fintech, b

Banks, MFIs, Insurers, and Insurtech.

To this day, this young and active urban mass lives and survives thanks to its own mechanisms, although these are not structured enough to serve the greatest number effectively. In addition, it remains open to financial services having an immediate economic impact on their lives while being the least restrictive for their daily activities.

At Diversity Pub, we combine proximity and knowledge of lifestyle habits in our approach to support our clients in the deployment of their marketing / sales strategy.