WOMEN’S FINANCIAL INCLUSION:

In the large metropolises of Sub-Saharan Africa such as Kinshasa or Abidjan, 70% of working women surveyed do not have access to financial services (bank accounts or insurance coverage).

This is quite surprising factual information when you know that the players in this industry are desperately trying to transform this target population into customers. These players make investments to optimize their “customer journey” but the return for a large majority of them is far from the potential offered by the market.

We can therefore legitimately ask ourselves what explains this trend and what are its main determinants? Of course there are historical and cultural reasons, however the surveys carried out in the field reveal criteria related to the income of this target, the customer journey that I offered them and, correlatively, their level of financial education.

In the sample studied, the penetration of financial services is higher among women with stable incomes and more educated than among others who are more difficult to convince.

Being hard to convince doesn’t mean that the relatively poor and less well-educated urban market doesn’t need risk coverage. Surprisingly, surveys in Kinshasa and Abidjan show that women are quite willing to buy financial products provided it has been clearly explained to them and they can see a direct impact on their lives.

The dilemma is slightly different when it comes to banking and savings;

- The majority of women surveyed are still unbanked

- Cash remains predominant in their personal and professional transactions and as such they do not see the added value of being banked especially if it will cost them in commissions and fees.

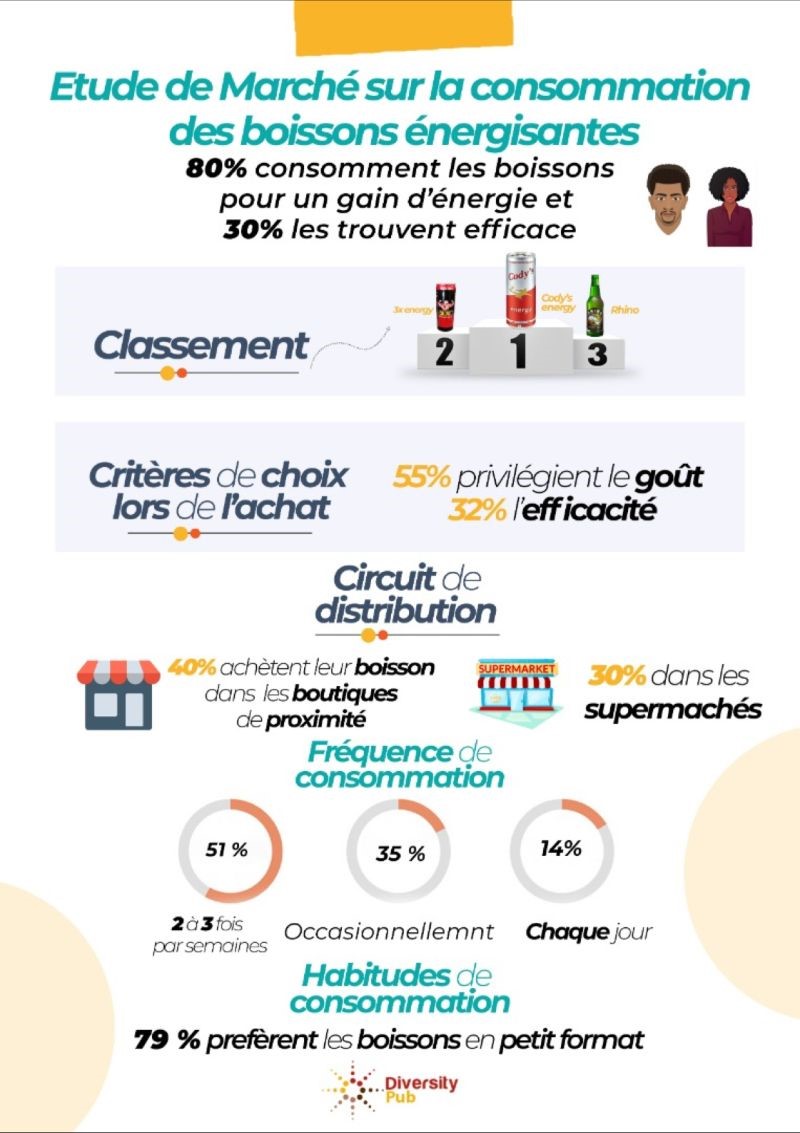

At Diversity Pub, we have designed marketing and business development tools to help financial services reach the mass market.